How to carry out biden regenger energy tax collidals becomes an important flashpoint among the Republicans of the Senate, as they try to advance their version of the “large, beautiful law”.

The Senate approaches the certificates for energy energy energy, which is less than the house, but is still a large rolback of intentions.

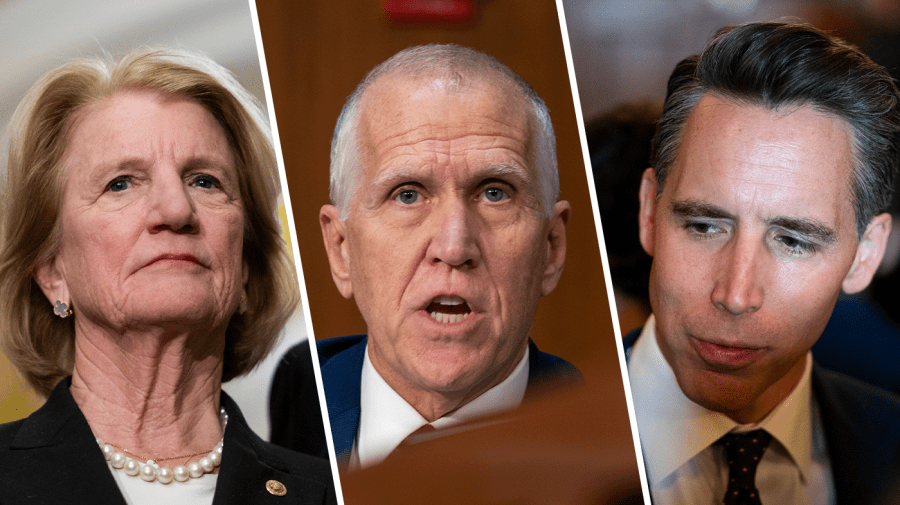

Members who oppose a complete cancellation of the login information that the upper chamber of the approach is still going too far. But Sen. Josh Hawley (R-Mo.) It has developed into a leading voice in which the subsidies are canceled faster.

Hawley told reporters this week that solar tax credits cost “a goll money”.

“The financing of the Green New Deal is like the least conservative things I can imagine,” he said.

The dynamics determine another task for the management, since the President Trump said, he hoped to sign the legislation by July 4 with high state and local taxes.

While Hawley, who opposes Medicaid, cuts pressing from the right, says that the green subsidies should be reduced, the legislators who demanded after popular would continue to see further changes.

“I think sen. [Mike] Crapo did a really good job, but even more work to do, “said Senator John Curtis (R-Hutah) to the hill and referred to the Republican Chairman of Idaho of the Senate Financing Committee.

Senator Thom Tillis (Rn.C.) – Like Curtis, a “targeted, pragmatic approach” to the tax credits and not for a “complete cancellation” – said reporters that he was generally satisfied with what Senate the Senate has invented.

“Tillis, who faces a clothing, saw the reception race next year, said on Wednesday.”

He expected “first adjustments”, especially with regard to the restrictions on the trust of the energy projects in China.

In the meantime, West Virginia Senator Shelley More Capito (R) said that it pushed for more flexibility for Tax credits for hydrogen energy.

Capito, in which the state is set up in one of several “hydrogen hubs” under the bidden administration, informed The Hill on Wednesday that she was the opportunity to “before the bumps” until the end of this year to qualify for the loan.

“This is a pretty tight timeline,” she said. “I try to push the date back.

However, she also said that she was not ready to torpedo the entire bill about the problem.

“It’s not a hard line for me, but I’m not the only one who has an interest in it,” she said.

The disagreements occurring in the GOP of the Senate come up with an EMPNNDER that gives the house together in which conservative freedom of Caucus says that it will not accept any changes that have the recently adapted cuts of the tax loans.

The house version includes provisions that were expected to maintain access to some credits, especially for wind and solar, e.g.

The Senate version removed this provision and some others passed the house and created some hard-line conservatives.

“You have found it or you make my voice,” Reporter Reporter Reporter this week. “The presidency is rightly fighting for the end of the green new fraud grants. It destroys our network.

In the house there was also a contingent of moderators for the tax credit, but most of them still vote for the draft law for the legal template of the more dramatic cuts. It is not clear which facility will win in the Senate.

The Law on Inflation Reduction of 2022 adopted by Democrat included the taxes of billions of billions of dollars for climate-friendly energy sources such as wind, solar and nuclear energy as well as emerging technologies such as hydrogen and carbon acceptance.

The Republicans have determined the goal of lifting these credits in a party as tax cuts and partly due to the ideological opposition to them.

Democrats have warned that the loans undermine the fight against climate change and that more greenhouse gases will contribute to a dangerously warming planet. And they argue that less renewable energies on the network mean higher energy prices.